Sustainability Strategy

ESG Strategy

SK ecoplant materials is evolving into a leading ESG company in the global materials industry.

We have established mid-to-long-term goals and implemented various activities for each ESG sector.

Evolving into a

Leading ESG Company

in the Global Materials Industry

-

Environment

- Establishment of environment-friendly workplaces

- Development of green products/services

-

Social

- Safe and healthy workplaces

- Management of a sustainable supply chain

- Co-prosperity with the local community

-

Governance

- Establishment of the Board of Directors operating system

- Ethical management and compliance at the world-class standards

ESG Management Activities

Identifying Stakeholders’ ESG Needs

SK ecoplant materials listens to stakeholders’ needs on material issues through various communication channels, and strives to reflect them into the management activities. Stakeholders’ needs are identified by the materiality assessment and reported through the Sustainability Report, and will be integrated into the business area by the stakeholder in-depth interviews. In 2021, SK ecoplant materials conducted the in-depth analysis for three major suppliers, and will start to broaden the coverage of stakeholders to customer, local communities and more.

- Identifying stakeholders' needs trough the materiality assessment

- In-depth analysis of three major suppliers

- Integrating broader needs by in_depth interview

- Expanding the coverage of stakeholder

Developing and Expanding Green Materials Products/Technology

SK ecoplant materials is focusing on developing green materials and technologies as a major direction for research and development, which can contribute to reducing the environmental impact of products and production process.

-

Reducing environmental

impact of products by

securing global CCUS

technology -

Upcycling waste

resources from

semiconductor

plants -

Securing green

raw materials -

Developing low

GWP green

cleaning gas -

Supplying

silicon anode material

for EV batteries

ESG Performance Evaluations for Executives

SK ecoplant materials evaluates ESG performance of all employees and reflects them in compensation system. All employees from each department, executives, and CEO set their KPIs to include 20~50% of ESG-related goals, and ESG performance are reflected in the final evaluation results and used as the basis of incentive payments. We are planning to subdivide the evaluation into detailed assessment and enlarge the proportion of ESG elements to motivate all employees to improve their ESG performance.

ESG Management of Subsidiaries

SK ecoplant materials is expanding ESG management to include its subsidiaries. SK ecoplant materials' 5 subsidiaries (SK Materials Air Plus, SK Trichem, SK Showadenco, SK Materials Renewtech, and SK Materials Performance) defined and implemented short/medium/long-term tasks by ESG indicator in 2022, and the management level will be improved step by step in the future. In addition, a company-wide consultative body is responsible for ongoing/regular ESG Agenda and task progress management, and subsidiaries regularly report key ESG issues to management/board of directors. Furthermore, from 2023, ESG disclosure will be expanded to all subsidiaries by publishing company-wide sustainable management reports, and the scope will be gradually expanded to overseas subsidiaries and new JV establishments.

- ESG information disclosure of all subsidiaries (homepage, sustainable management report)

- Major subsidiaries’ implementation of short / med-term ESG tasks

- Expansion of ESG management and information disclosure scope to overseas subsidiaries

- Overall ESG level upgrades through regular ESG level management and mid-term task implementation of major subsidiaries

- Expansion of ESG management and information disclosure scope to new JV establishment

- All subsidiaries’ achievement of the same level of ESG management performance as SK ecoplant materials

Implementation Performance

- Establishing ESG management policies for subsidiaries

- Managing implementation and performance of subsidiary ESG tasks through an ESG synergy consultative body involving major subsidiaries

- Check and disclosure of ESG performance of major subsidiaries (homepage)

- Publication of a "Net-Zero Report", which contains the Net Zero·RE100 declaration and roadmap of SK ecoplant materials and its 7 subsidiaries (SK Materials Airplus, SK Trichem, SK Resonac, SK Materials Renewtech, SK Materials Performance, SK Materials JNC, and SK Materials Group 14)

New Business Development/Investment with ESG Criteria

SK ecoplant materials is applying ESG standards to new business development and investment activities to pursue ESG management,

aligned with the investment portfolio deliberation policy and the deliberation process of report and approval by executives.

The decisions are made based on calculation of SV (Social Value) Potential of new business/investment portfolio,

and the SV impact as results are monitored.

ESG Investment Deliberation Process

ESG Investment Roadmap

SK ecoplant materials takes into account stakeholders’ needs including those for transformation into a low-carbon society, and plans to expand its investment in new green business and environmental investing in stages.

- Establishing/executing ESG investment deliberation process

- Improving SV Potential measurement and results monitoring

- Expanding new green business and environmental investing with ESG criteria

ESG Disclosures

SK ecoplant materials published its very first Sustainability Report in 2021, and we plan to disclose ESG information in accordance with the following disclosure standards through the Sustainability Report.

GRI

SK ecoplant materials identified and disclosed sustainability management topics based on the GRI Standards Core Option through the Sustainability Report.

TCFD

SK ecoplant materials disclosed relevant information through the Sustainability Report in accordance with TCFD (Task Force on Climate-related Financial Disclosure) Recommendations. All disclosed information based on the TCFD Recommendations is reviewed and approved by executives/BOD.

- TCFD Index reporting

- Establishing mid to long-term strategies based on TCFD Pillars

- Disclosure of detailed information adopting the revised TCFD Guideline

- Reporting detailed information through TCFD Report

SASB

SK ecoplant materials disclosed relevant information through the Sustainability Report in accordance with SASB (Sustainability Accounting Standards Board) Standard. All disclosed information based on the SASB Standard is reviewed and approved by executives/BOD.

- SASB Index reporting

- (on Sustainability Report and official website)

- Disclosure of detailed information adopting the revised SASB Index

- Expanding reporting channel to improve SASB information accessibility

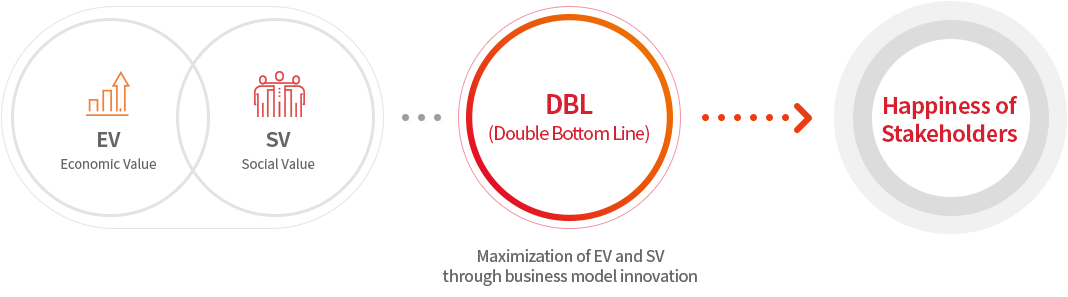

DBL Management

Through DBL (Double Bottom Line) management, SK Group aims to maximize economic value (EV) and social value (SV) in its business activities, and achieve mutual growth with society while creating diverse values for stakeholders including customers and society. SK ecoplant materials seeks to adopt and innovate DBL business models to create its own EV and SV.

Social Value (SV) Measurement System

SK Group has developed and used monetary-based social value metrics methodology composed of three sectors:Indirect Economic Contribution Performance, Business Social Performance, and Social Contribution Performance.It is a global trend to monetize and measure ESG performance and, accordingly,SK Group also plans to lead the global standardization of social performance measurement based on the DBL management.SK ecoplant materials has measured its social value since 2018 according to the SK Group's DBL methodology,and the SV creation result has constantly increased along with its EV.

| Indirect Economic Contribution Performance | Employment | Dividend | Tax Payment | |

|---|---|---|---|---|

| Business Social Performance | Environment | Resource consumption | Water | |

| Environmental pollution | Greenhouse gas / Air pollution / Water pollution / Waste / Land use & Biodiversity | |||

| Social | Quality of life | Increasing public interest / Crime prevention / Reducing inequality / Social service, etc. | ||

| Consumer protection | Quality / Safety / Information | |||

| Labor | Employment of vulnerable groups / Quality of life / Safety and health of employees | |||

| Mutual growth | Fair trade / Mutual growth with suppliers / Social contribution & procurement / Safety and health of suppliers | |||

| Governance | ※ Governance indicators are under review for future assessment | |||

| Social Contribution Performance | CSR Activities | Donation | Volunteer work | |

Social Value (SV) Creation

Unit: 100 Million KRW

| 2019 | 2020 | 2021 | |

|---|---|---|---|

| Social Value (SV) Performance | 1,392 | 1,738 | 3,153 |

| Economic Interference | 1,843 | 2,204 | 3,767 |

| Employment | 952 | 1,141 | 1,391 |

| Dividend | 477 | 593 | 1465 |

| Tax Payment | 415 | 470 | 892 |

| Benefits | - | - | 19 |

| Environment* | ▲537 | ▲586 | ▲821 |

| Society | 86 | 120 | 206 |

| Labor/Shared Growth* | 71 | 72 | 136 |

| Social Contribution | 15 | 48 | 70 |

*Includes product and service performance